「たまには誰かと肌を重ねたいけれど、付き合うのは面倒くさい」「後腐れなく遊べる相手が欲しい」

そんなふうに思っていても、リアルな生活圏内で都合のいい相手を見つけるのは至難の業ですよね。職場や友人の紹介で手を出してトラブルになるのは絶対に避けたいところです。

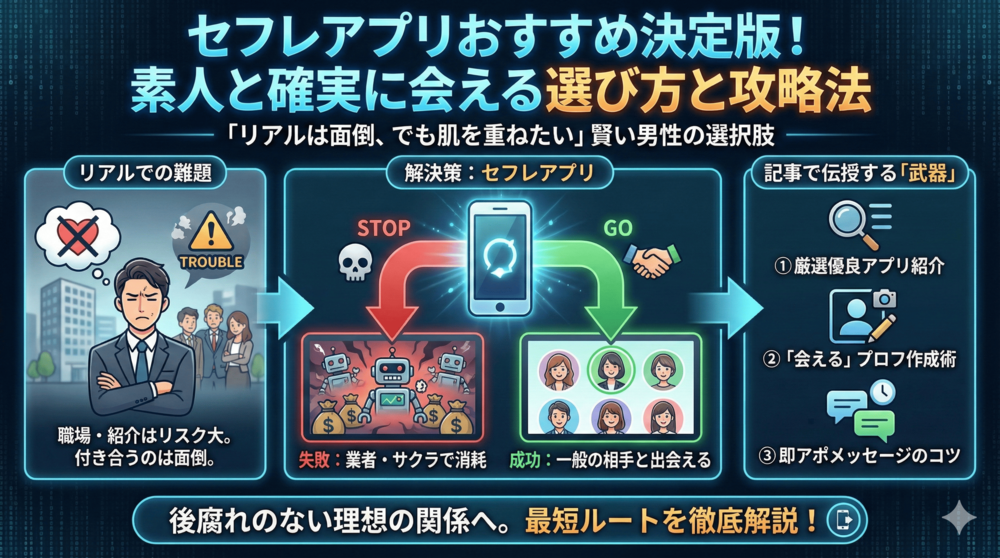

そこで今、賢い男性たちがこぞって使っているのがセフレアプリです。スマホ一つで理想の相手を探せる便利なツールですが、実はアプリ選びを間違えると「全然会えない」「業者ばかりで消耗した」なんてことになりかねません。

この記事では、数あるアプリの中から本当にセフレ作りができる優良アプリを厳選して紹介します。さらに、ただアプリを入れるだけでなく、確実に会うためのプロフィールやメッセージのコツまで余すことなく解説していきます。

無駄な時間とお金を使わず、最短で理想のパートナーを見つけるためのバイブルとして、ぜひ最後まで読んでみてください。

なぜ今、セフレ作りにはマッチングアプリ一択なのか

一昔前までは、遊び相手を探す場所といえばナンパ箱や合コン、あるいは夜のお店が主流でした。しかし、令和の今、最も効率よくリスクを抑えて相手を探すなら、間違いなくマッチングアプリが最強の選択肢です。

なぜこれほどまでにアプリが支持されているのか、他の手段と比較しながらその理由を紐解いていきましょう。時間もお金も有限ですから、賢い選択をすることが成功への近道です。

風俗やキャバクラよりも圧倒的にコスパが良い

まず一番の理由は、圧倒的なコストパフォーマンスの良さにあります。

風俗やキャバクラなどの夜のお店は、確実性はありますが、一度遊ぶだけで数万円単位のお金が飛んでいきます。それが毎月となれば、かなりの出費です。一方で、マッチングアプリの多くは月額数千円程度の定額制です。一度登録してしまえば、何人とメッセージしても、何人と会っても追加料金はかかりません。

以下の表で、それぞれの出会い方の特徴を簡単に比較してみましょう。

| 出会い方 | 1回あたりの費用 | 難易度 | 特徴 |

| マッチングアプリ | 月額4,000円前後 | 中 | コスパ最強で一般人と出会える |

| 風俗・キャバクラ | 20,000円以上 | 低 | お金がかかるが確実、ただし業務的 |

| 合コン・街コン | 5,000円~10,000円 | 高 | 幹事の手配や当たり外れが大きい |

| ナンパ | 0円~ | 特高 | メンタルと高いトーク力が必要 |

表を見るとわかるように、アプリは非常にバランスが良い手段です。もちろん、お店のような「お客様扱い」はありませんが、その分、対等な関係でお互いに楽しめるのが大きな魅力です。

業者ではない一般の女性と出会えるチャンス

「ネットの出会いなんて、どうせ業者かサクラしかいないでしょ?」と思っているなら、その認識は少し古いです。

今のマッチングアプリ、特に大手のアプリは身分証による本人確認や24時間の監視体制が非常に厳しくなっています。そのため、怪しい業者はすぐに排除され、ユーザーのほとんどが「普通に出会いを求めている一般人」です。

普段生活しているだけでは接点がないような、看護師さんや保育士さん、女子大生やOLの方々と繋がれるチャンスがスマホの中に広がっています。素人の女性とドキドキするような関係になれるのは、アプリならではの醍醐味と言えるでしょう。

お互いの目的が一致しやすいから話が早い

リアルな場での出会いだと、相手が彼氏持ちなのか、そもそも遊びたい気分なのかを見極めるのに時間がかかります。一生懸命口説いたのに「彼氏いるから無理」と断られた時の徒労感は半端ではありません。

しかし、セフレ作りを目的としたアプリや、カジュアルな出会いを推奨しているアプリであれば、登録している女性も「気軽な関係」を求めています。

プロフィールやコミュニティ機能で「まずは会って話したい」「細かいことは気にしない関係がいい」といった意思表示をしている相手を選べば、マッチングした時点で目的が一致している状態です。余計な駆け引きをショートカットして、スムーズに会う約束まで進めることができるのです。

失敗しないセフレアプリの選び方

「アプリなら何でもいい」と思って適当に登録していませんか?実はこれが一番の失敗原因です。アプリにはそれぞれ「カラー」があり、ここを間違えるとどれだけイケメンでも、どれだけトークが上手くても全く会えません。

お金と時間をドブに捨てないために、セフレ作りにおける正しいアプリの選び方を押さえておきましょう。

「婚活」ではなく「遊び」目的のアプリを選ぶ

マッチングアプリ業界には、大きく分けて「婚活」「恋活」「遊び(デート)」の3つのカテゴリが存在します。セフレを作りたいのに「婚活」ジャンルのアプリを使ってしまうのは、寿司屋でカレーを注文するようなものです。

真剣に結婚相手を探している女性が多いアプリで、「軽く飲みに行かない?」と誘っても、ブロックされるのがオチですし、最悪の場合、運営に通報されて強制退会させられます。

以下の表で、アプリのタイプとユーザーの真剣度を整理しました。

| アプリのタイプ | ユーザーの目的 | セフレ作りの難易度 |

| 婚活アプリ | 結婚前提の交際 | 激ムズ(非推奨) |

| 恋活アプリ | 彼氏・彼女探し | アプリによる(見極めが必要) |

| デート・遊びアプリ | 食事・気軽な出会い | 最適(入れ食い状態も狙える) |

表にある通り、狙い目は圧倒的に「デート・遊びアプリ」です。あるいは、恋活アプリの中でも「気軽な出会い」を許容している機能を備えたものを選びましょう。自分の目的に合った場所で戦うことが、勝利への第一歩です。

会員数と年齢層のマッチングをチェックする

次に重要なのが「会員数」と「年齢層」です。

どんなに機能が優れたアプリでも、過疎っていて会員がいなければ意味がありません。特に地方に住んでいる場合は、会員数が数百万人規模の大手アプリを選ばないと、検索しても「近くに相手がいません」と表示されて終わってしまいます。まずは会員数が多いアプリを選ぶのが鉄則です。

また、自分の年齢や狙いたい相手の年齢層に合ったアプリを選ぶことも大切です。例えば、あなたが40代なのに、ユーザーのほとんどが20代前半のアプリを使っても、ジェネレーションギャップでマッチングしにくくなります。逆に、女子大生と遊びたいのに年齢層高めのアプリを使っても出会えません。

「自分がどの層に需要があるか」と「どの層と出会いたいか」のバランスを見て、戦場を選ぶようにしましょう。

本気で遊べるおすすめセフレアプリ厳選紹介

ここからは、実際に実績があり、セフレ作りにおすすめできるアプリを厳選して紹介します。

世の中には数え切れないほどのアプリがありますが、会員数が少なかったり、機能が使いにくかったりと、実用レベルに達していないものも多いです。ここでは「会員数」「出会いやすさ」「ユーザーの真剣度(遊び目的度)」の観点から間違いないものをピックアップしました。自分のスタイルに合いそうなものから試してみてください。

会員数最大級で出会いの数が桁違いなアプリ

まず最初に押さえておきたいのが、国内最大級の会員数を誇る「Pairs(ペアーズ)」や「タップル」といった大手アプリです。特に「タップル」は、20代の若い世代が多く、直感的な操作で相手を選べるため、カジュアルな出会いに非常に向いています。

この手のアプリの強みは、なんと言っても「母数の多さ」です。田舎や地方であっても会員数が多いため、近場で会える相手が見つかりやすいのが特徴です。「おでかけ機能」のような、当日のデート相手を募集する機能があるアプリを選べば、マッチングから会うまでのスピード感も格段に上がります。まずはここから登録して、アプリの操作感に慣れるのが王道です。

気軽なデートから始められる若年層向けアプリ

メッセージのやり取りよりも、「まずは会って食事でも」というスタイルを好むなら、「Dine(ダイン)」のようなデート特化型アプリがおすすめです。

一般的なアプリは「マッチング→メッセージ→デートの約束」という手順を踏みますが、デート直結型アプリは「マッチング=デートの日程調整」となります。お店もアプリ側が予約してくれるため、面倒な店選びも不要です。

月額料金は少々高めですが、メッセージでダラダラと時間を浪費するのが嫌いな忙しい男性や、とりあえず顔を見て話したい派の男性には最強のツールと言えます。食事をご馳走する前提であれば、マッチング率はかなり高くなります。

大人の関係を求めるユーザーが多い穴場アプリ

割り切った関係をストレートに求めたいなら、昔からある「ポイント制のマッチングサイト(アプリ)」も選択肢に入ります。ワクワクメールやハッピーメールなどが有名です。

これらは月額制ではなく、メール1通ごとにポイントを消費する都度課金制であることが多いですが、その分、ユーザー層も「遊び慣れている人」や「特定の関係を求めている人」が多く集まっています。

一般的なマッチングアプリよりも年齢層が幅広く、30代、40代の男性でも戦いやすいのがメリットです。「掲示板」機能を使って目的を明確にした募集ができるため、条件さえ合えば即日で会うことも夢ではありません。ただし、業者も一定数紛れ込んでいるため、見極める目は必要になります。

無料で使えるチャンスがある海外発アプリ

最後におすすめするのは、世界中で利用されている「Tinder(ティンダー)」です。

このアプリの最大の特徴は、位置情報を使って近くにいる相手を探せることと、男性でも基本機能が無料で使える点です(課金すれば機能は拡張されます)。プロフィール写真と数行の自己紹介だけで判断されるため、外見に自信がある男性や、魅力的な写真を撮れる男性にとっては、まさに入れ食い状態を作れるアプリです。

ユーザー層も非常にラフで、外国の方や旅行中の人とマッチングすることもあります。課金へのハードルが高いと感じる方は、まずはTinderで写真写りを研究しながら、無料の範囲で試してみるのも良いでしょう。

ライバルに差をつける「会える」プロフィールの作り方

アプリをインストールして、「よし、これで女の子選び放題だ!」と思っていませんか? 残念ながら、それはスタートラインに立っただけです。

マッチングアプリにおけるプロフィールは、いわばあなたの「商品パッケージ」です。中身がどれだけ良くても、パッケージがボロボロだったり怪しかったりすれば、誰も手に取ってくれません。特に女性は、男性が思っている以上に写真と文章をシビアにチェックしています。

ここでは、女性が「この人なら会ってみてもいいかも」と直感的に感じる、”売れる”プロフィールの作り方を伝授します。

清潔感と安心感を与える写真の選び方

プロフィールの命運を握るのは、9割が「写真」です。ここでナシ判定されると、自己紹介文すら読まれません。

まず絶対に避けるべきなのが、洗面所の鏡越しに撮った無表情な「自撮り」です。これはナルシストっぽく見える上に、暗い印象を与えてしまい、女性受けは最悪です。

では、どんな写真が良いのか。ポイントを表にまとめました。

| 写真の種類 | おすすめのポイント | 備考 |

| メイン写真 | 友人に撮ってもらった自然な笑顔(他撮り) | 顔がはっきり分かり、明るい場所で撮影されたもの |

| サブ写真1 | 全身が写っている写真 | 服装の雰囲気や体型がわかると安心感アップ |

| サブ写真2 | 美味しそうな料理やお酒の写真 | 「美味しいお店に連れて行ってくれそう」と連想させる |

| サブ写真3 | 趣味を楽しんでいる写真 | アウトドアやスポーツなど、爽やかさをアピール |

「イケメンじゃないから無理」と諦める必要はありません。重要なのは顔の造形よりも「清潔感」と「雰囲気」です。髪を整え、シンプルな服を着て、友達とカフェにいる時のような自然な笑顔の写真を一枚用意してください。それだけでマッチング率は劇的に変わります。

必死さを消して余裕を見せる自己紹介文の書き方

写真で合格点をもらえたら、次は自己紹介文です。ここでやりがちな失敗が、真剣さをアピールしすぎて「重い長文」になってしまうこと、逆に短すぎて「ヤリモク丸出し」になってしまうことです。

セフレ作りにおいて重要なキーワードは「余裕」です。「別にガツガツしてないけど、気が合えば仲良くしたいな」くらいのスタンスが、女性にとって一番心地よく、警戒心を解きやすいのです。

以下の構成を参考に、400字以内でまとめてみましょう。

- 挨拶:「はじめまして!プロフィール見てくれてありがとうございます。」

- 仕事:「都内で〇〇関係の仕事をしています。」(※社会的な安心感を提示)

- 趣味・好きなこと:「週末は美味しいご飯を食べに行ったり、Netflix見たりして過ごしてます。」

- 登録理由・目的:「仕事も落ち着いてきたので、美味しいお酒やご飯を一緒に楽しめる人と出会えればと思って登録しました。」

- 締めの言葉:「まずはメッセージで仲良くなれたら嬉しいです。よろしくお願いします!」

あえて「遊び相手募集」とは書かず、「ご飯」「お酒」「楽しい時間」という言葉に変換するのが大人のマナーでありテクニックです。行間から「大人の余裕」を漂わせましょう。

マッチングから即アポにつなげるメッセージ術

「マッチングした!」と喜んで、いきなり「LINE交換しよう」「今夜会える?」と送っていませんか? それは、釣れた魚を陸に上げる前に網を放り投げるようなものです。即ブロックされて終了します。

マッチングした直後の女性は、まだあなたに対して「ちょっといいかも?」程度の興味しかありません。ここから「会いたい!」という感情まで引き上げるには、スマートなメッセージのやり取りが必要です。面倒な駆け引きは不要ですが、最低限の手順と礼儀は守りましょう。

最初の1通目は短文で返信しやすく

最初の1通目は、これからの関係を決める重要なファーストコンタクトです。ここで長文の自分語りを送ったり、質問攻めにしたりするのはNGです。相手は一日に何通ものメッセージを受け取っている可能性があるので、パッと見て返信しやすい内容を心がけましょう。

【OK例】 「はじめまして!マッチングありがとうございます。 〇〇さんの写真の雰囲気が素敵だなと思っていいねしました。 美味しいお店巡りが好きなんですね!僕も好きなので仲良くしてください😊」

【ポイント】

- 挨拶と感謝:礼儀正しさは必須です。

- いいねした理由:軽い褒め言葉を入れると好感度が上がります。

- 共通点への言及:プロフィールから話題を拾い、「あなたに興味がある」ことを示します。

- 疑問形で終わらない:最初はあえて疑問形にせず、相手が自由に返せる余白を残すのもテクニックです(もちろん、軽い質問ならOK)。

これくらいシンプルで爽やかな内容なら、女性も「普通の人だな(安心)」と感じて返信をくれます。

相手の反応を見ながらスムーズに会う約束を取り付ける

2〜3往復ほどやり取りが続き、相手のテンションが悪くないと感じたら、早めに会う打診をしましょう。ダラダラと世間話を続けても、「メル友」認定されてフェードアウトされるだけです。セフレ作りにおいては、スピード感が命です。

自然な流れで誘うためのテンプレートを紹介します。

【ステップ1:食の話を振る】 あなた:「そういえば、〇〇さんはお酒とか結構飲まれるほうですか?🍺」 相手:「はい、週末はよく飲みます!」

【ステップ2:共感+誘い】 あなた:「いいですね!僕も飲むの好きなんです。 よかったら今度、美味しい焼き鳥屋さんがあるんで、軽く一杯どうですか?😊」

このように、「食事」や「お酒」を口実に誘うのが最も警戒されにくく、かつ断られにくい方法です。「ホテル行こう」は論外ですが、「飲みに行こう」ならOKしてくれる確率は跳ね上がります。

もし「まだ会うのはちょっと…」と渋られたら、無理に押さずに「了解です!じゃあもう少しここでお話しましょうか」と余裕を見せて引くこと。この「引く姿勢」が逆に信頼を生み、次のチャンスに繋がります。

これだけは避けるべき!業者やサクラの特徴

マッチングアプリは非常に便利なツールですが、残念ながらユーザーを騙そうとする「業者」や「サクラ」と呼ばれる悪質なアカウントもゼロではありません。彼女たちは、あなたのお金や個人情報を狙っています。

しかし、恐れる必要はありません。彼女たちの手口はワンパターンなので、特徴さえ知っていれば簡単に見抜くことができます。貴重な時間とポイントを無駄にしないために、怪しいアカウントの特徴を頭に入れておきましょう。

会話がかみ合わない・URLを送ってくる

最も分かりやすい特徴は、メッセージの内容とタイミングです。

マッチングして挨拶をした直後に、いきなり「スマホの調子が悪いから、こっちでやり取りしよう」と言って、謎のURLを送ってくるケースは100%業者です。普通の女性が、使い慣れたアプリをわざわざやめて、見ず知らずのサイトに誘導することは絶対にありません。

また、こちらの質問に対して答えがズレていたり、会話のキャッチボールが成立しなかったりする場合も要注意です。あらかじめ用意された定型文を機械的に送っている可能性が高いです。「なんだかAIと話しているみたいだな」と違和感を覚えたら、すぐにブロックして次へ行きましょう。

プロフィール写真が綺麗すぎる・露出が激しい

男性ならついつい目が行ってしまうのが、露出の激しい写真や、モデルのような美女の写真です。しかし、ここにも罠があります。

一般の女性が、胸の谷間を強調した写真や、プロのカメラマンがスタジオで撮ったような完璧な写真をメインに設定することは稀です。あまりにも写真が綺麗すぎる場合、ネット上の画像を無断転載している「なりすまし」の可能性があります。

特に、「年収1000万以上の方限定」や「パパ活」を匂わせるような文言と一緒に、キラキラした写真が掲載されている場合は、投資詐欺やマルチ商法の勧誘であるケースが多いです。少し画質が荒かったり、背景に生活感が写り込んでいたりするくらいの写真の方が、実在する女性である確率は高いと言えます。

セフレアプリに関するよくある質問

ここまで読んでも、まだ心のどこかに「本当に大丈夫かな?」という不安が残っているかもしれません。特に初めてアプリを使う場合、誰にも聞けない疑問が出てくるのは当然です。

ここでは、セフレ作りを検討している男性からよく寄せられる質問に、包み隠さず本音で回答していきます。不安要素をゼロにして、スッキリした気持ちでスタートを切りましょう。

アプリで身バレすることはありますか?

結論から言うと、100%バレないとは言い切れませんが、バレる確率は限りなくゼロに近づけることができます。

多くのアプリには「Facebook連携」機能があります。「Facebookで登録したら友達にバレるんじゃ?」と思いがちですが、実は逆です。Facebook連携を使うと、Facebook上で繋がっている友達がアプリ内で表示されなくなる(相手からも見えなくなる)仕組みになっていることがほとんどです。

また、どうしても心配な場合は、プロフィールの公開範囲を制限できる「プライベートモード」などの有料オプションを使う手もあります。これを使えば、自分が「いいね」した相手にだけプロフィールが表示されるので、身バレのリスクを鉄壁の守りで防ぐことができます。

既婚者でも利用して大丈夫ですか?

これは非常にデリケートな問題ですが、アプリによって規約が異なります。

Pairs(ペアーズ)やタップルなどの大手「恋活・婚活アプリ」では、利用規約で既婚者の利用を明確に禁止しています。もし登録して通報された場合、強制退会などの厳しい処分を受けることになりますし、最悪の場合、慰謝料トラブルなどに発展するリスクもあります。

一方で、出会い系サイトや既婚者専用のマッチングサービスなど、一部のサービスでは利用が黙認されている、あるいはターゲット層に含まれているケースもあります。ただし、どのアプリを使うにせよ、既婚であることを隠して独身女性と関係を持つのは「貞操権の侵害」として訴えられるリスクがあるため、絶対に推奨できません。遊ぶならリスク管理は徹底し、自己責任で動く覚悟が必要です。

本当に無料で会えるアプリはありますか?

「タダで会いたい」という気持ちは痛いほど分かりますが、「完全無料で安全に会えるアプリ」は、ほぼ存在しないと思ったほうが良いでしょう。

例外として「Tinder」などは無料でマッチングからメッセージまで可能ですが、ライバルが桁違いに多く、相当なイケメンか写真詐欺レベルの加工をしない限り、出会うのは至難の業です。

また、完全無料を謳う怪しいアプリは、個人情報の収集が目的だったり、サクラだらけだったりすることが大半です。月額3,000円〜4,000円は「安全に、確実に女性と出会うための必要経費」と割り切りましょう。飲み会1回分のお金で1ヶ月間チャンスが広がると思えば、決して高い投資ではありません。

まとめ:まずは無料登録から!理想の関係はすぐそこにある

記事を読み終えた今、あなたの手元には「セフレを作るための地図」と「武器」が揃いました。あとは、一歩を踏み出す勇気を持つだけです。

ここまで解説してきた通り、現代においてマッチングアプリほど効率的で、安全かつ低コストに遊び相手を探せるツールはありません。合コンの幹事に頭を下げたり、高いお金を払ってお店に行ったりする必要もありません。スマホ一台あれば、今夜の予定が変わるかもしれないのです。

最後に、成功するための秘訣をもう一度だけお伝えします。それは「行動の早さ」です。

あなたが「どのアプリにしようかな」と迷っているこの瞬間にも、新しく登録した可愛い女性は、他の素早い男性とマッチングしてデートの約束を取り付けています。チャンスは待ってくれません。

まずは、この記事で紹介したアプリの中から、直感で気になったものを1つ選んでインストールしてみてください。そして、無料登録をして、どんな女性がいるのか検索してみましょう。

「意外と近所に可愛い子がいるな」 「自分でもイケそうな子がいるかも」

そう実感できれば、あとは自然と体が動くはずです。

難しく考える必要はありません。まずは気軽な気持ちで、新しい出会いの扉を開いてみてください。最高のパートナーが見つかることを応援しています。